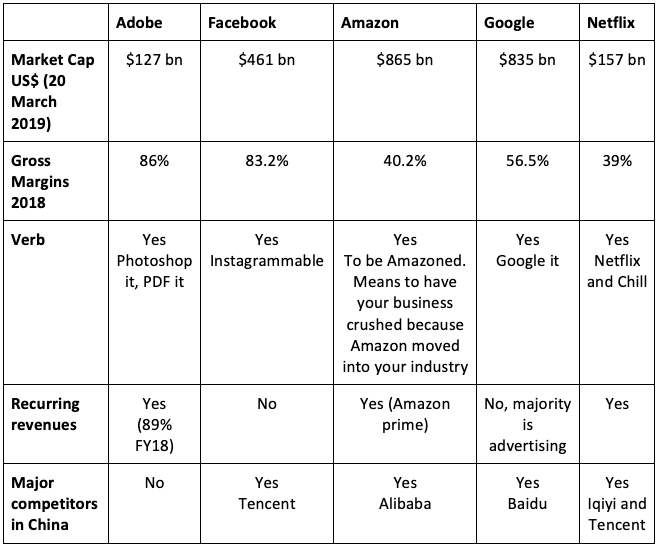

Facebook, Amazon, Netflix and Google (FANG) dominate their industries and investor attention. Yet, there is another stock, listed since 1986, that also dominates its industry and yet is hardly ever mentioned in the press.

The stock is Adobe.

Adobe owns not one but two products that have become verbs.

Adobe Photoshop and Acrobat PDF.

“Just Photoshop it” and “Can you PDF it?”.

Adobe’s products are digitising the world. Most technology companies like to say they are saving the world, but in Adobe’s case they are saving trees and saving us from paper. It’s an environmentally friendly company.

It’s worth noting now! No paper was harmed in the production of this document.

Photoshop is the design and editing tool for creatives. Photoshop is to publishing and graphics what Microsoft Office is to business. Everyone knows or has used PDFs.

Their Creative Cloud (Photoshop plus others) drives the majority of sales.

Adobe is the creativity platform; more than 90% of the world’s creative professionals use Photoshop. Photoshop equips users from emerging artists to global brands with the tools they need to create media. Adobe is responsible for Photoshop, InDesign, Adobe XD and Illustrator.

Creativity is a great business to be in. The ability to reach customers through Instagram and YouTube means everybody and every brand is a creative. Everyone has a story to tell.

Document cloud (PDF)

Adobe is a trusted PDF solution, which saves a gigantic amount of paper. PDF is the language of electronic documents, with 250 billion PDFs opened in the last year. Adobe is an environmentally friendly solution; using document cloud drives a 91% reduction in environmental impact compared to paper based processes. Over half a billion copies of Adobe Reader have been downloaded for mobile devices.

Adobe also has a marketing business called Experience Cloud. Helping companies reach their customers through marketing, advertising, analytics and commerce. Similar to Microsoft, Adobe’s products work well with each other.

What makes Adobe different to the FANGS is its Asian potential; 15% of sales last financial year were from Asia. Every FANG company has a Chinese equivalent but not Adobe. We can understand countries banning social networks and search engines but it's unlikely to do so for creative software. It's a big opportunity if China and if the US can agree to stronger intellectual property protection. Adobe will be one of the technology companies to benefit.

The OG

Every company talks about the cloud. Another company we currently invest in via our Spaceship Universe Portfolio and our Spaceship Index Portfolio, Salesforce, is widely credited as being one of the pioneers of cloud computing. Adobe was one of the first large traditional software companies to transition to the cloud, announcing in 2011 it will begin its transition from selling software boxes to digital subscriptions. The stock dropped 6% that day. It was a big change internally, from marketing a new online route to customers, more frequent product updates and a change in financial reporting.

Adobe’s transition to the cloud influenced Microsoft, Autodesk and Intuit to make similar cloud transitions. Adobe has taken their time, but they announced they are finally releasing the full Photoshop software on iPad sometime in 2019. This will make the company’s products more broadly compatible across many devices.

Multiple trends

The shift to the cloud is doubly powerful, with collaboration and computing power benefits. Video and image editing are hardware intensive. With the cloud, users can offload and utilise cloud resources to carry out computing. The power of the iPad Pro and other mobile devices mean tablets can finally handle the rigors of an intensive creative product like Photoshop, where cloud collaboration is extremely important to team productivity.

The cloud makes Adobe products more accessible and reduces piracy. More than 45% of Creative Cloud subscribers are new (as at October 2018).

This used to be below 20% when Adobe first started the transition to Creative Cloud, multiple price points and the ability to run project use cases are increasing the addressable market. Mobile and video are also factors with more people creating their own channels increasing adoption.

Two verbs for the price of one

We believe Adobe is one of the best positioned companies in technology with multiple growth tailwinds.

Most technology companies have Chinese equivalents while Adobe has none, opening up the potential for Asia an option most technology companies don’t have.

The switching costs for Adobe users are high and the creative industry is booming thanks to the internet and social media.

Companies that become verbs are rare. And we like with Adobe its a two for one deal: two verbs (Photoshop and PDF) for the price of one company, while also saving enormous amounts of paper for businesses and individuals around the world.

Important! We’re sharing with you our thoughts on the companies in which Spaceship Voyager invests for your informational purposes only. We think it’s important (and interesting!) to let you know what’s happening with Spaceship Voyager’s investments. However, we are not making recommendations to buy or sell holdings in a specific company. Past performance isn’t a reliable indicator or guarantee of future performance.

The Spaceship Universe Portfolio currently invests in Adobe, Amazon, Apple, Autodesk, Facebook, Alphabet, Microsoft, Netflix and Salesforce.

The Spaceship Index Portfolio invests in Adobe, Amazon, Apple, Facebook, Alphabet, Microsoft, Netflix and Salesforce.