Key points from the Libra whitepaper:

- Libra is a new blockchain-based global payments system the Libra Association, of which Facebook is a founding member, plans to launch next year.

- In contrast to Bitcoin, Libra will be backed by a basket of global government bonds and bank deposits and will not be fully decentralised.

- Libra will be governed by Facebook and more than two dozen founding partners (such as Visa, PayPal and Uber), as part of the project’s governing consortium, the Libra Association.

- The Libra blockchain is open-source and uses a new programming language called Move.

- Facebook will launch the Calibra wallet, which will be built into WhatsApp and Messenger, as well as being a standalone app.

On 17 June, Facebook announced plans to create Libra, a new global-spanning digital currency for mainstream users. Facebook’s 2.7 billion users gives the company a unique advantage to launch such an ambitious project.

Recently we wrote about digital payments and how many intermediaries sit between the consumer and the merchant, each collecting their own fee. Libra could have the opportunity to leapfrog existing solutions by being cheaper and more efficient.

If Facebook can successfully launch a product that takes off with users, it could be transformative for the global financial system. But will governments allow Facebook to launch a borderless payments system using a newly-created cryptocurrency?

Let’s delve into the details.

1. Facebook Libra v Bitcoin and Ethereum: What’s the difference?

Libra is designed very differently to cryptocurrencies such as Bitcoin or Ethereum, despite being built on a blockchain system.

Firstly, it’s backed by fiat currency. Every time someone buys Libra with their local currency, the money goes into the Libra Reserve and an equivalent value of Libra is created and distributed to the user. Similarly, every time someone redeems Libra, the units are destroyed, and they receive the equivalent value of their local currency back. The value of the Libra in circulation is 100% collateralised with real-world assets in the Libra Reserve at all times. This is intended to keep the price of Libra stable. Some people have argued that Bitcoin and other cryptocurrencies aren’t practical as a store of value and medium of exchange, given their wild price swings.

The other big difference is that Libra is not fully decentralised. The Libra system is managed by a limited number of nodes, which are servers that help operate the blockchain. Each of the 100 (anticipated) members of the Libra Association will operate a node. This is in contrast with decentralised systems like Bitcoin where all users can run a node and participate in block production. Decentralisation generally mitigates some of the risks associated with data being held centrally, such as being more resistant to attacks, single points of failure, and preventing government censorship.

The flipside is that centralised systems currently facilitate much faster payment times than decentralised systems; this has always been a limitation with cryptocurrencies. Facebook expects Libra will be able to process 1,000 transactions per second at launch, while Bitcoin processes 7 transactions per second and Ethereum processes 15 transactions per second. Visa, which is centralised, processes 24,000 transactions per second.

Facebook believes decentralisation is important for Libra in the long run and states it plans to begin the transition to a fully decentralised system in five years. It will need to resolve many issues first, such as scaling. Adding more nodes slows things down and Facebook have not been able to find a solution yet.

2. Why does Libra use a blockchain system anyway?

A blockchain-based system, even a partially decentralised version with 100 nodes, potentially offers more stability than centralised payment systems.

With Visa and Mastercard (centralised payment systems) controlling a large percentage of all money flow, the card networks have become part of society’s critical infrastructure. But they’re not foolproof. There was a Visa outage in Europe last year that significantly disrupted transactions, with reports of some ATMs in the United Kingdom running out of cash within a couple of hours. Weeks after, Mastercard also suffered outages around the world. Libra could be more reliable since it is partially decentralised. Facebook believes that Libra’s protocols will still function correctly even if up to a third of the 100 nodes are compromised or fail.

3. How does Libra stack up on privacy?

On privacy, Facebook says: “The Libra Blockchain is pseudonymous and allows users to hold one or more addresses that are not linked to their real-world identity.”

This is the same as Bitcoin and Ethereum. It means that transactions aren’t linked to your name like credit card transactions. But your cryptocurrency wallet will probably still know who you are.

While the network itself doesn’t require identity verification, the network's endpoints (i.e. where users exchange money for Libra) need to follow CTF (“counter terrorism financing”) and AML (“anti-money laundering”) laws and regulations, which require proving real world identity. Again, this would be similar to Bitcoin exchanges such as Binance and Coinbase, where users exchange their money for cryptocurrencies and who must also implement AML/CTF. There are also some unregulated exchanges and wallets around the world that don’t verify identity and where users can transact in Bitcoin anonymously.

Facebook says that its new Calibra wallet, which will be used as a tool to send and receive Libra, will implement an AML/CTF program globally, even though it says Calibra will not act as an exchange. Facebook hopes Libra will be listed on exchanges and there will be authorised resellers/market makers that will manage network’s endpoints.

Something else to consider is that cryptocurrencies have, at their core, a public ledger. This means that every single transaction is permanently recorded and viewable by anyone in the network. In fact, it’s possible to identify individuals based on their usage patterns and potential IP address leakage. We don’t know if Libra will be the same, or whether the ledger can only be viewed by the entities running the nodes.

Making a purchase using a Calibra wallet is arguably more private than, say, a PayPal account linked directly to your name, but it’s not super private at the end of the day. Neither are Bitcoin and Ethereum transactions.

4. How would Libra work in practice?

Users sign up for a digital wallet, such as Facebook’s Calibra, using their government-issued ID. Then they load local currency into the platform and convert it to the Libra currency.

Users can then send Libra to friends and family, and to small merchants at point-of-sale using a QR code. Facebook expects there will be “dozens” of other wallets to choose from, in addition to its own Calibra wallet.

Facebook will probably make it easy for users to buy and sell Libra within the wallet using their bank account or credit card. In some frontier and developing markets, it might be convenient to exchange physical money for Libra in person, like how M-Pesa utilises prepaid mobile recharging kiosks.

5. Why would people use it?

Libra is likely to be cheap and easy to use with Calibra being built into Messenger and WhatsApp. We don’t know what fees will be charged for local currency to Libra conversions, but transactions themselves will be almost free. The Libra Association will charge a tiny fraction of a cent fee that will be negligible for most customers, and is mostly there to deter spam and denial of service attacks

Libra could catch on the fastest in emerging market economies. We’ve written previously about how digital wallets by Tencent, Alibaba and Kenya’s M-Pesa have leapfrogged banks and credit cards in some countries, thanks to cheap and accessible ways to send and receive money using mobile phones. With WhatsApp widely used in emerging markets such as India, Malaysia, Brazil, South Africa, and Indonesia, Libra/Calibra could become a formidable competitor. It's interesting to note that Vodafone, owner of M-Pesa, is listed as one of the founding members of the Libra Association.

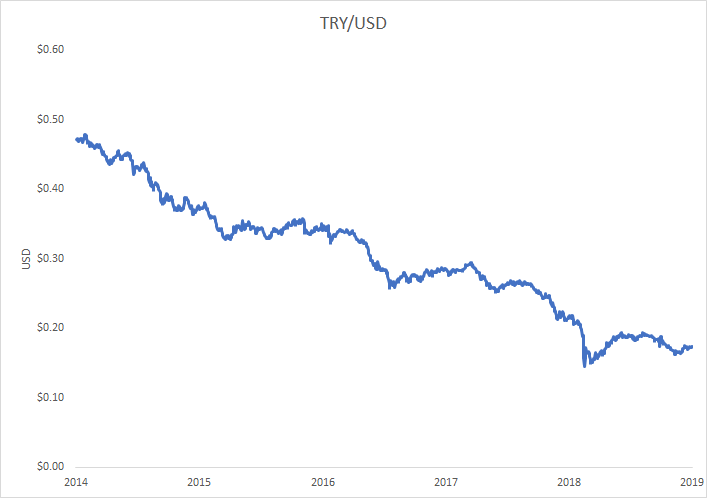

Libra/Calibra will be different to M-Pesa and WeChat Pay by being a cryptocurrency linked to a basket of low-volatility assets, rather than using the local currency. There will probably be a learning curve with understanding how this works and whether the new currency is trustworthy. On the other hand, users could potentially see Libra as an attractive store of value because emerging market currencies tend to be volatile. Residents could use Libra to hedge against currency depreciations which decrease their own purchasing power.

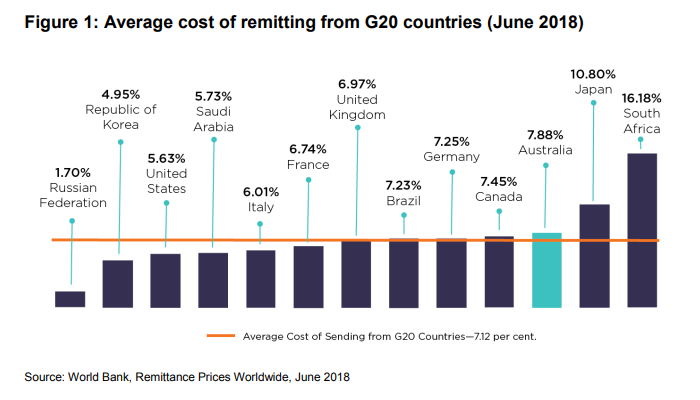

Cheaper and easier cross-border transactions could be a massive boon for Libra in emerging markets. Each year, billions of dollars are sent by migrant workers to their families back home, with the biggest remittance recipients being India, China, Mexico and the Philippines. The UN estimates there are around 200 million migrant workers around the world who send money back home and around 800 million people that receive these flows. It’s not cheap to send money home with the average commission coming to around 7% and the costs for sending money to Africa going up to 20%.

Libra would be particularly useful in countries that have experienced a currency crisis and hyperinflation (where the currency essentially becomes useless). In Venezuela, Bitcoin transactions rose to an all-time high this year, as residents opted to hold bitcoin, rather than their national currency, as a store of value. We’d expect governments to prohibit these transactions in the event of a full-blown currency crisis though.

Day-to-day transactions in developed markets could be harder to crack. Electronic payments using the card networks are generally accessible and efficient for users, so there probably isn’t a strong incentive for users to switch. Launch partners such as Uber and Booking.com might offer incentives and sign-on promotions to get people using Libra. On the other hand, merchants may prefer Libra over card networks since the cost of accepting card payments can be quite expensive in some countries. Merchants are currently charged a card interchange fee of up to 3.5% by banks in the United States.

Libra would be useful for cross-border transactions in developed markets too. International wire transfers using the SWIFT system are expensive and take up to a week to settle. The big four banks in Australia charge the sender between $12 and $30 for a single wire transfer and usually charge a mark-up on the exchange rate.

6. Will regulators allow Facebook to launch Libra?

This is the key question. In order to fulfil its vision of a global, borderless cryptocurrency, Libra will need to win the approval of governments around the world.

While Facebook has designed the project in a way to win public trust, by creating the Libra Association to govern the blockchain and removing itself from control, there’s no disguising the ambitiousness of the project. On the release of its whitepaper, Facebook has already attracted significant criticism from lawmakers who think Facebook has a bad track record when it comes to personal data and is already too powerful.

Libra will be entering uncharted waters in terms of regulation. Regulators around the world have different approaches to cryptocurrency regulation, with some countries, such as China, prohibiting trading altogether, and others expressing support. New regulations are being debated and considered. Libra says its Founding Members are "committed to working with authorities to shape a regulatory environment that encourages technological innovation while maintaining the highest standards of consumer protection."

The company confirmed Calibra will not operate in markets that have taken a stand against cryptocurrencies, such as China and India, or those that are sanctioned by the US like North Korea. This immediately thwarts the image of Libra as a global, borderless currency.

From our perspective, countries are unlikely to approve a digital payments system if policymakers took the view that it could undermine their own currency and central banks’ ability to conduct monetary policy. Facebook will probably try to convince policymakers that Libra won’t be that disruptive and that it can co-exist alongside the local currency.

It will likely be a long and challenging journey for Facebook to convince lawmakers and regulators that Libra is worth the risk.

7. What are the implications for investors and how will Facebook monetise Libra?

Other than the interest that Facebook and other members of the Libra Association will earn on the money held in reserve, there doesn’t seem to be any other revenue generators for Facebook right now. Instead, the company is playing the long game. If Facebook successfully executes its plan, it could potentially create an ecosystem that it would be the biggest beneficiary from. Potential revenue streams could take the form of financial services (such as lending and investing), e-commerce (through integration with Facebook Marketplace and Instagram Checkout), and additional traffic to the core ad business.

As one of the cheapest FAANG stocks at the moment, the stock could potentially re-rate if investors think Libra can deliver long term growth. Many investors are skeptical that Facebook’s digital advertising model can hold up due to privacy concerns by users and potential regulation. Any diversifying streams of income would be viewed favourably.

8. What are the wider implications if Libra is successful?

Banks would be negatively impacted, as they currently earn the largest part of the fee (the interchange fee) charged to merchants for credit card payments.

Payments companies such as Visa and Mastercard and digital wallet providers such as PayPal would also be negatively impacted, though their involvement in Libra probably puts them one step ahead.

If Libra is allowed to operate in multiple jurisdictions and is able to carve out their place in cross-border transactions, this may impact incumbents such as Western Union and TransferWise, which may be forced to cut their fees to compete.

If Libra takes off in economies at scale and begins to displace the local currency, this could impact the central banks’ ability to use monetary policy as a lever to influence economic growth and inflation. It could also intensify the impact of potential currency crises, by deepening the local currency depreciation, if a flight-to-safety to Libra is allowed. However, it is difficult to see governments allowing Libra to reach this point.

Bottom Line

Facebook’s digital payments project could be a watershed moment for the company as it looks to expand its footprint beyond digital advertising. The biggest challenge for Libra is whether it can persuade regulators to allow it to get off the ground.

It could be the next evolution of digital payments, and validation for the use of blockchain technology in financial services. We’re particularly interested if Libra is able to transition to a fully decentralised ledger and the implications of a widely used, decentralised payments system.

We can also see useful applications for Libra, particularly in emerging markets where the banking system is underdeveloped and non-inclusive.

While Libra isn’t going to be an immediate earnings driver for Facebook, it provides the company with long-term growth opportunities in financial services and e-commerce and scope to further entrench their position in digital advertising.

The Spaceship Universe Portfolio and the Spaceship Index Portfolio currently invests in Facebook

Important! We’re sharing with you our thoughts on the companies in which Spaceship Voyager invests for your informational purposes only. We think it’s important (and interesting!) to let you know what’s happening with Spaceship Voyager’s investments. However, we are not making recommendations to buy or sell holdings in a specific company. Past performance isn’t a reliable indicator or guarantee of future performance.