A lot has been written on this blog about the perils of credit cards and getting into debt. It’s a big problem for many people. ASIC has reported that as at June 2017, 18.5% of Australian consumers were experiencing or may potentially experience problematic credit card debt with outstanding balances totalling $45 billion.

Some personal finance advisors advocate cutting up your credit card altogether. This seems to be sensible advice for many people, especially the estimated 30-40% of credit card holders that pay interest on their balance.

However, I take a different approach to credit cards. I’ll highlight some of my strategies for getting tremendous value out of using credit cards (as well as some potential pitfalls), and some of the awesome trips I’ve been able to take.

Please note that these strategies are not for everyone. If you have difficulty paying off your credit card balance every month, this isn’t for you.

Churning credit card sign-on bonuses

There are lots of ways to earn credit card points and frequent flyer points. From filling up at the gas station to booking restaurants, you can earn Qantas or Velocity points for nearly everything these days without even stepping onto a plane.

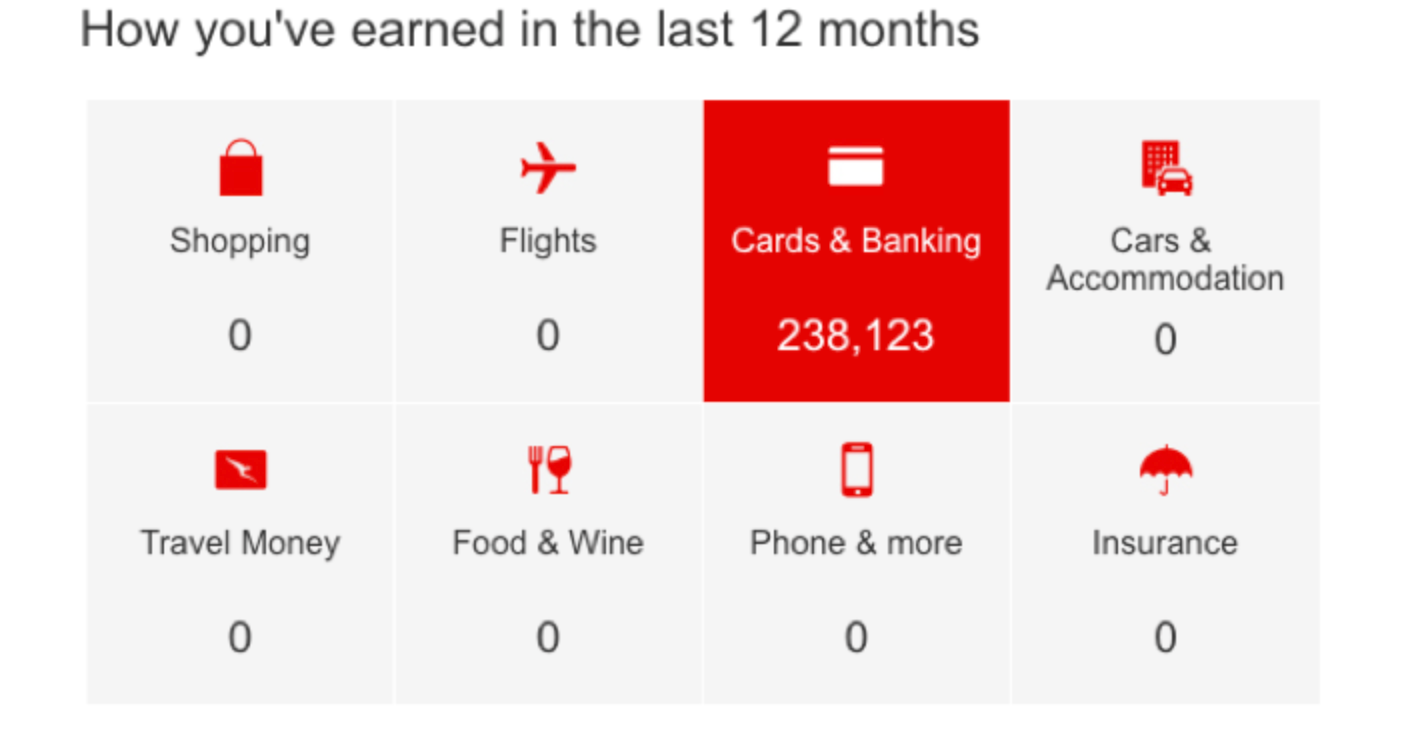

But the way I earn the vast majority of my points is through credit card sign-on bonuses. In the last few years, many banks and credit card issuers have been offering large sign-on bonuses for their credit cards. It’s common to see cards offering between 40,000 to 120,000 Qantas or Velocity points, and they’re usually awarded after the user completes a minimum spend, often between $1,000 to $4,000.

When these sign-on bonuses coincide with a waived or significantly discounted annual fee, that’s when I strike.

Once I’m approved for a credit card, I put all my daily spend on the new card until I reach the minimum spend. Sometimes it’s an effort to meet the minimum spend with just daily spend, so I try to time credit card applications with large expenses such as paying exam fees for a professional qualification or paying car rego.

Once the credit card issuer dishes out the bonus points (there can be a significant delay), I generally cancel the credit card. Then I rinse and repeat. I can generally churn through at least three to four credit cards a year, allowing me to amass hundreds of thousands of points.

The key to getting value out of churning credit cards is to always pay off your balance every month to avoid paying interest and to make sure it’s not changing your spending habits. You don’t want to spend more money just because you can put it on credit!

Keeping an eye on your credit score

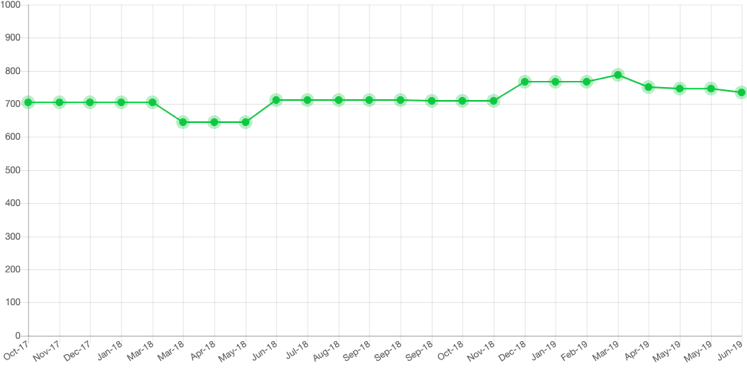

The main downside to churning credit cards is the potential impact on your credit score. Every credit card application will generally have a negative effect on your credit score, with the magnitude depending on credit limit and your credit history (including when you last applied for consumer credit).

I check my credit score every month and try to maintain it at the ‘good’ level or above (using Equifax). For me, this has been achievable with three to four applications spread out across a year but your mileage may vary. A good credit score makes it more likely that banks will approve your credit card application and can be important if you want to take on a mortgage down the line.

I recommend everyone using a credit product (i.e. credit card, personal loan, mortgage) checks their credit score regularly. The online tools I use are GetCreditScore and Credit Savvy.

Finding the best value redemptions

Once you’ve earned the points, what then?

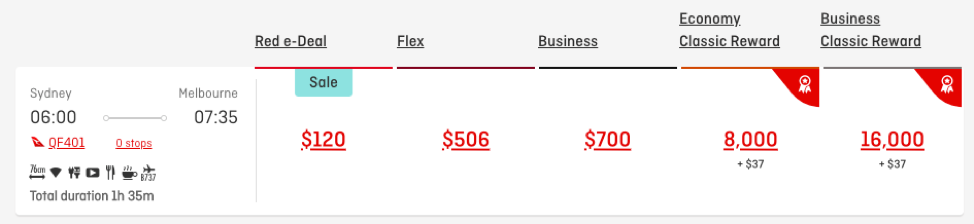

This is where many people slip up. While you can certainly redeem your Qantas Frequent Flyer points for a toaster in the Qantas Store, you can get better value out of your points by redeeming them for a flight, or even better, a business or first-class flight.

Reward seats (seats that can be booked with frequent flyer points) can be difficult to find, especially in peak season travel. For points collectors, it’s worthwhile to book well in advance or to be extremely flexible with your travel plans. The best availability for reward seats is often a year from the travel date, when the calendar opens for bookings.

It’s worthwhile to look outside of Qantas Frequent Flyer and Velocity Frequent Flyer as well. While they might be harder to access, foreign frequent flyer programs can offer higher value redemptions. Currently, you can convert American Express Membership Rewards points to Singapore Airlines Krisflyer, Asia Miles, Etihad Guest, and Virgin Atlantic Flying Club, among other programs.

Points are not limited to airlines either. I’ve been able to take advantage of hotel loyalty programs such as Hilton Honors and Marriott Rewards, and redeemed points for free hotel nights.

Booking a round-the-world trip in business class

One of my favourite point redemptions is the Qantas Oneworld Classic flight reward, which allows you to fly around the world with up to five stops (not including layovers). It costs 280,000 Qantas points per person (poised to rise to 318,000 in September 2019) in business class, plus taxes and fuel surcharges.

While business class is the sweet spot in terms of value and being able to find reward seats, you can also book economy for 132,400 points and first class for 420,000 points (poised to rise to 455,000 in September 2019).

This redemption can be quite complex and time-consuming to book, and it often involves the use of Qantas’ multi-city online booking tool and maybe having to call up Qantas a few times. But it’s definitely worth the effort!

Check out the blogs and forums

There’s lots of information available online for point collectors, from how to earn points to all the creative ways you can redeem points for travel.

Blogs and forums are a good place to start your research. My favourites are the Australian Frequent Flyer and Flyertalk forums.

Earn and burn

Earn and burn should be the mantra for a points collector.

The best points redemptions (or opportunities to earn) don’t often stick around for long, as the airlines and banks are frequently devaluing their rewards programs and changing the rules of the game.

Qantas recently announced they were raising the number of points required for business class and first-class redemptions by around 15%. Velocity points have also recently experienced a devaluation. As of 1 January 2019, 100,000 Velocity points convert into 64,516 KrisFlyer miles rather than 74,074 KrisFlyer miles under the previous rate.

Most of the deals I’ve bagged no longer exist. Like when I spent a mere 40,000 United MileagePlus miles to jet off to Bangkok in first class (which included a 1-hour neck and shoulder massage and a buggy ride around Bangkok Airport).

Or when Amex was giving 60,000 points for each friend you signed up and I amassed enough miles to fly to Europe and back in Singapore Airlines Suites Class.

That’s why it’s best to earn points and use them quickly. Plus, it forces you to travel more often!

Bottom line

Credit card points have really changed the way I travel and have enabled me to see more places while spending less money. And as someone who would never spend their money on anything other than economy class seats, occasionally flying business class or first class makes getting to your destination all the more fun.

Proceed with caution though. Keeping on top of your credit cards cannot be more important! One missed payment can be extremely expensive. And applying for too many credit products, too quickly, can also have a detrimental impact on your credit score.