When you're investing for your retirement, especially through your superannuation, it's a different game to short term investing. To understand why, let's look at why putting money into a savings account isn't the best way to create a retirement-ready nest egg.

Super gives you decades of time in the market and time in the market is one of the most important parts of investing.

Why is long-term different to short-term savings?

If you're investing for the long term, it's different to putting money aside for your next holiday. Yes, they're both ways of saving money but they serve different purposes, and require different ways of thinking.

Most financially savvy people will suggest you save anywhere between a few months to a year worth of cash into a savings account, and that is a great idea for financial security. It could save the day if you need to move, are unable to work for awhile, or an unexpected medical bill appears.

But a few months of savings isn't enough for retirement and a savings account usually isn't the right way to go about it. The reason being savings account don't give much of a return.

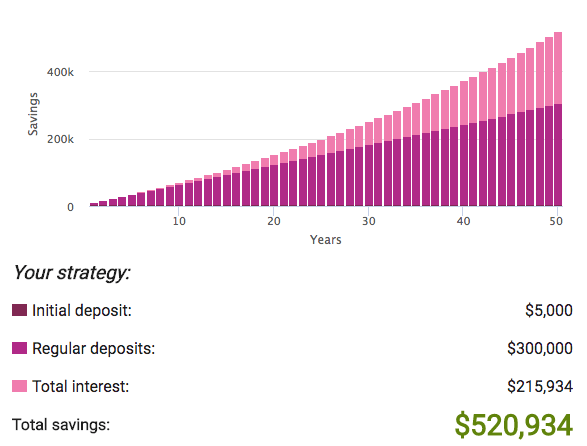

Say you put $5,000 into your savings account, add $500 a month for 50 years, and you have an average interest rate of 2% per year, you'll be looking at a balance of $520,935.

$520k is a lot of money, no doubt.

50 years may seem like ages, but that's what your superannuation is, a long term investment vehicle. Depending on how old you are, you're looking at 10 to 50 years until retirement.

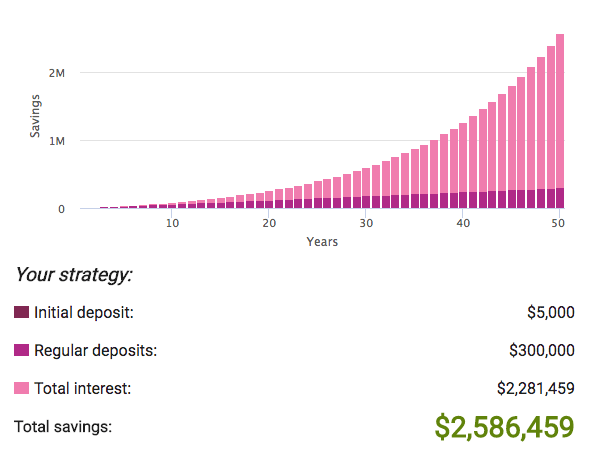

Now, let's look at what happens if you invested that same amount in the market, rather than a bank account. Say you earn an average of 7% a year for 50 years, put $5,000 as the initial investment, and add $500 a month, you'd now be looking at $2,586,459.

That's about 5 times more than what you'd have in the first example.

Long-term investing is in a different ball park to investing for even five to ten years. An example of that style of investing is saving for a down payment on a house, we'll cover that in a future post.

When we're talking about your superannuation, it's important to think forward until your retirement, not five years down the line.

Why is time in the market so important?

It's hard to think about when you retire, especially if it's decades off. For most of us, it's so far away we can't even be bothered to think about it. We ignore our superannuation until we can't any longer.

We don't think this is the right approach. By taking an interest early on in your life, you can set yourself up to capture more time in the market and that's more time for you to earn compound interest on each dollar.

If you think 25 is too young to start thinking about your Super, here's the difference between putting $5,000 in the market, with monthly contributions of $500 earning 7% each year, for 40 years, versus 50 years.

After 40 years, your investment would be worth $1,272,683 and after 50 years it doubles to $2,586,459, or more than a million dollars extra.

Yes your Super is automatically taken out of your paycheck each month, but that doesn't mean you shouldn't be thinking about where it's going, or how much extra you want to put in. A little extra could be a whole lot more later.

And don't worry if you've forgotten about your Super until now, it's not too late. You can still get to where you need (or want) to be. You'll need to think about how much to contribute on a regular basis to get there.

It's better to have too much Super, than too little.

Longer-term goals can mean different risk tolerances

Investing never comes without risk but by building your portfolio over decades, and investing where you think the world is going, spread across asset classes and geographies, you can take advantage of differing market conditions.

If you're young, lower asset prices can actually be a good thing. You buy more for less and as long as the market recovers in time for your retirement, you'll be fine. Historically, this has proven to be true time and time again.

We're not saying past performance is a guarantee of future performance and black swans can happen, like we said above no investment is without risk.

We believe the more time you are invested in the market, the more time you'll have to weather financial storms as they come. There's one thing we can say for certain, investments go up and down, and sometimes they make no sense at all.

As a long-term investor, you don't have to worry about timing the market, if you don't want to. No one can predict what the market will do next but anyone can dollar-cost average into the market like we all do with our Super.

With your superannuation, you're adding money on a consistent basis and buying the average price over time.

Anyone can start thinking about their Super, in fact we think you should. It doesn't matter what you get paid or what your current balance is. You're never too young. Starting early can put you ahead and your future self will thank you.