Align Technology owns the world’s leading invisible orthodontic product Invisalign. Invisalign is disrupting orthodontics as a clear alternative to braces. Clear aligners are perfect for the Instagram age, people want the perfect smile but won’t put up with braces to get there. It’s the end of a traditional rite of passage for teens, they will no longer have to be photographed with wire braces in school yearbooks.

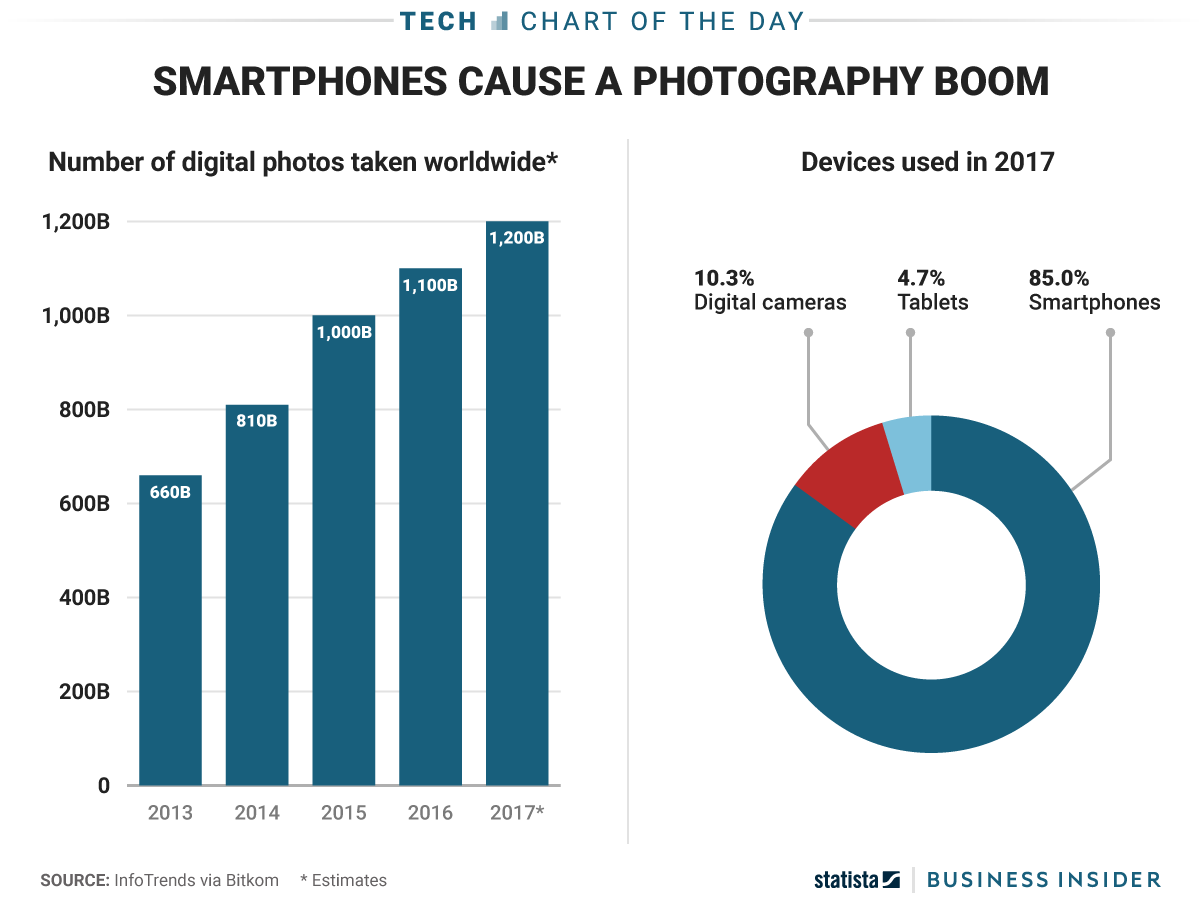

Invisalign benefits from what we call the Instagram effect, a perfect smile is important when everyone has a camera in their pocket. High quality cameras on our smartphones and social media mean more photos are being taken than ever before. In 2017 (see above) 1.2 trillion digital photos were taken, that’s 160 pictures each (7.5 billion people on the planet). There is more demand for a perfect smile and Invisalign is making it easier to fix your teeth.

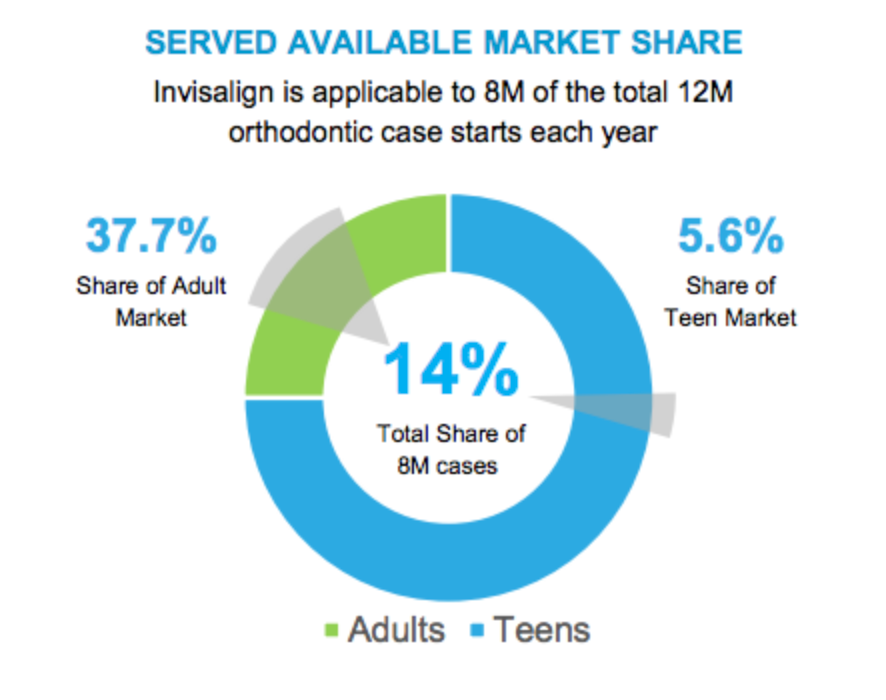

Clear aligners account for just 14% of orthodontic treatments each year. We believe clear aligners remove a barrier for adoption, expanding the addressable market for orthodontics. Align estimate there are 300m people with malocclusion (teeth misalignment) that could benefit from teeth straightening, all we need to do is make it easier and cheaper for customers ie no wire braces. There are currently 12m orthodontic cases each year.

Clear alternative to braces

Plastic aligners sound simple but it’s a complex business. Align has the largest 3D printing operation in the world, printing over 380,000 unique parts everyday. Their operations are at scale with customisation, the barriers to entry for just producing aligners is hard.

- Materials. Something strong enough to move teeth, be clear, weightless and safe enough to put in the mouth. Moving teeth with plastic is hard.

- Need to invent your own 3D printing equipment. Align have developed their own technology over the years.

- Post processing. Parts require polished surface finish for comfort.

Smile changing technology

3D printing is complex because no set of teeth are the same; much like fingerprints, everyone is different. Aligners are made within 100 microns (width of human hair) for a good fit and more comfort, requiring 2 million computations per aligner, 10 million measurements per treatment plan and 3 million lines of code per aligner. Invisalign has a database of 6.1 million patient treatment plans.

This patient data is key. Each smile makes the system smarter, and with every treatment it becomes more convenient for customers. It compounds both ways if errors are made, costs go up and treatments take longer for customers. At their investor day in May 2018, the SVP of Global Operations quoted “build times are about 10 to 20x faster than others in the space. We use 40 to 50x less material than others in the space. And we have a cost that's about 10x lower than anyone else in the space.” The combination of scale and data is impressive, Invisalign leads in costs because of scale and quality helped by data that is used to continually improve their product resulting in a faster and more convenient service for customers.

Expanding smiles

There are 12 million orthodontic cases each year (see below). Invisalign believe their products are applicable to nearly 70% of overall traditional cases and increasing (plastic can’t cure everything yet). The teenage market is interesting; it is approximately 75% of overall orthodontic cases in 2017 but only 27.1% (Q4 2018) of Align Technology’s volume. Invisalign have a large share in the adult market, we believe this can translate to the teen market, especially because of the Instagram effect.

Align also have a scanner business which is 16.5% of revenue. It’s a strategy of see more, show more and treat more. Offering complimentary iTero scans and simulations allows patients to visualise each stage of the treatment process leading to increased adoption of treatments. Seeing is believing.

Needed both doctors and customers

Invisalign is a two-sided network with customers and doctors (dentists and orthodontists). Invisalign spends over $100m a year marketing its brand. Its high consumer awareness drives traffic to doctors, leading to the largest network of trained doctors that in turn makes it easier for customers to sign up. It’s a mini-network effect. These doctors need to buy into the systems and training creating a switching cost in terms of time and money making them unlikely to leave the system.

Competitive advantage/moat

Branding: Invisalign is the clear aligner brand (a noun like Kleenex).

Switching cost: 151,955 trained doctors. Time and effort for doctors to change.

Network effect: More customers lead to more doctors leading to more customers.

Patents: 872.

Scale: Largest mass customisation 3D printing operation.

Data: Data and insights on 6.4m patient treatment plans. More data = better treatment plans for patients.

Source: Corporate Fact Sheet

Some of Align’s patents are expiring but we believe the barriers above are still substantial. When you have entrenched sales, brand recognition, data, scale and high doctor adoption it's very difficult for new competitors.

That said there is competition in the form of Smile Direct Club where users bypass the dental office for at home impressions. We believe the market is at such an early stage that Smile Direct by offering simpler treatment cases at home increases the addressable market rather than eating into Align’s market share.

I want Invisalign, I don’t want braces

Invisalign is the clear aligner brand much like Kleenex for tissues. It’s amazing the teenage market makes up only 27.1% of volume and that clear aligners account for only 14% of the braces market. We are confident this undersells the opportunity much like Uber expanded the market for ridesharing rather than looking at it as just taking market share from the taxi industry. We believe clear aligners will expand the use cases for braces, increasing adoption and leading to growth for a long time to come.

Important! We’re sharing with you our thoughts on the companies in which Spaceship Voyager invests for your informational purposes only. We think it’s important (and interesting!) to let you know what’s happening with Spaceship Voyager’s investments. However, we are not making recommendations to buy or sell holdings in a specific company. Past performance isn’t a reliable indicator or guarantee of future performance.

The Spaceship Universe Portfolio is invested in Align Technology at the time of writing.