Key points:

- MercadoLibre is Latin America’s largest e-commerce company. It’s similar to eBay/PayPal, as it has an emerging fintech business.

- We believe MercadoLibre’s fintech division is a hidden gem with the opportunity to expand payments from just their marketplace to stores and the internet. Since eBay spun off PayPal, its market value is now 3x that of eBay.

- PayPal invested US$750m into MercadoLibre, announcing a partnership that allows their combined 500 million customers to access each other’s payment networks.

- Latin America is underbanked. Annual credit card interest rates equal nearly 300%.

- Brazil is a pioneer in “buy now, pay later.” Nearly half of all e-commerce purchases are paid for by instalment.

MercadoLibre, which means “free market” in Spanish, accounts for 26% of Latin America’s online retail sales. It has 292.5 million registered users out of a population of 362 million internet users, with Brazil its largest market.

We like to call MercadoLibre the eBay/PayPal of Latin America, but it's also similar to Amazon and Shopify. It’s the PayPal payments analogy that we find most interesting.

MercadoPago is the fintech opportunity

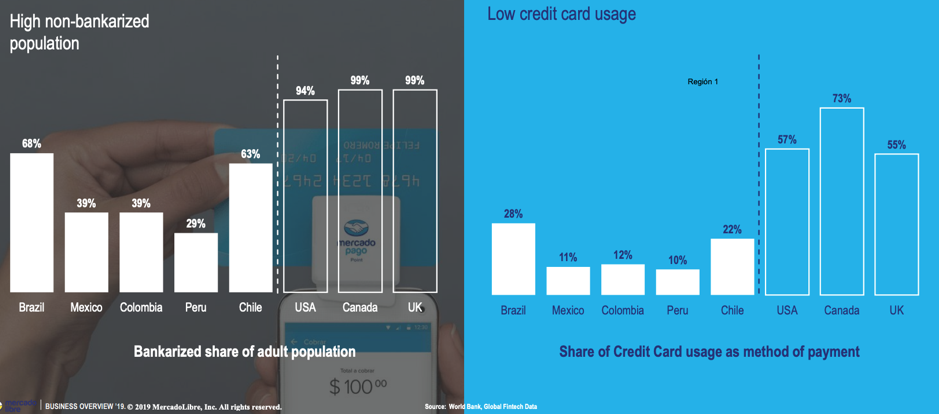

E-commerce is an interesting market but fintech in Latin America is even more interesting. Most users don’t have bank accounts, credit card usage is low, and banking is highly concentrated. We believe MercadoLibre’s most promising business is their fintech or digital financial services division, MercadoPago.

Almost 300% credit card rates

According to Brazil’s Central Bank, the average annual percentage rate of interest on credit cards reached 299.8% in May 2019. High interest rates generate a vicious cycle, causing customers to default, which leads to high rates and curbs demand for loans. It also spells opportunity if a company can get data and lending right.

400 million people are without bank accounts or credit histories in the region

Brazil is underbanked. Five banks are responsible for 82% of consumer lending, stifling competition. Credit history is difficult when there are no bank accounts or credit cards. MercadoLibre’s marketplace data of buyer and seller activity is a competitive advantage for MercadoPago; it’s effectively credit history, allowing for risk analysis and lower rates for customers.

The real pioneer in “buy now, pay later” instalments

Instalment payments are not just an Afterpay invention. In Brazil, half of all e-commerce transactions involve instalment billing. MercadoLibre’s marketplace sellers can offer instalment payment options, making purchases more attractive for customers. The fintech business MercadoPago keeps a % of the instalment payment, passing on a discounted amount to the seller. Just like Afterpay, its interest-free to the buyer, with the seller bearing the cost.

Hindsight asset management

Imagine being able to invest in PayPal ten years ago? The great part about global investing is seeing what is working around the world and applying learnings to countries elsewhere. We saw fintech and payments take off in China as smartphones led to rapid adoption of digital payments. We also saw how eBay helped PayPal grow larger than itself. Similarly, MercadoPago started life as a way to facilitate transactions on MercadoLibre’s marketplace.

MercadoPago and MercadoLibre following PayPal and eBay

It’s hard to start a new fintech or payment system because of network effects; both customers and merchant sellers are needed. The more it is accepted, the more powerful the network effect becomes. Early on, PayPal was able to use eBay’s marketplace to achieve scale in their business and were so successful that eBay bought them. Once PayPal was large enough, eBay spun them out as a separate company.

PayPal is now bigger than eBay

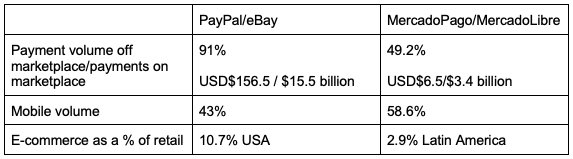

PayPal’s market value is now over 3x larger than eBay’s, as it began to facilitate transactions all over the internet, rather than just eBay. EBay is now 9% of PayPal’s total payment volume. We believe we could see the same with MercadoPago and MercadoLibre, with the fintech business hopefully being worth multiples more than the original marketplace as they process transactions in shops and online, rather than just the MercadoLibre marketplace.

Taking on Amazon in the Amazon

A key risk with MercadoLibre is Amazon ramping up in Brazil. Amazon have opened a logistics warehouse and have similar market share to MercadoLibre in Mexico.

But we believe MercadoLibre has a strong competitive moat because of its size, with 292.5 million registered users out of 362 million internet users. It’s also more than just an e-commerce marketplace.

From marketplace to fintech, MercadoPago is the difference

We believe MercadoLibre is building a hard-to-replicate ecosystem. Their online marketplace, payments, and logistics divisions are significant barriers against competition, as shipping and payments infrastructure is not as developed compared to the United States. MercadoPago’s payments create a barrier against Amazon as a trusted payment system. Amazon has to compete not just with the marketplace but financial services as well. The marketplace and fintech divisions can help each other grow with cross-selling and product subsidies, with the network effect going both ways. We believe other products such as asset management and mobile saving products can help lock customers into their ecosystem.

PayPal invests in MercadoLibre

It’s not just Spaceship that sees the opportunity; PayPal sees it as well. PayPal recently invested US$750 million into MercadoLibre. It’s just not the money either; they also agreed to a partnership, integrating their combined 500 million customers around the world. MercadoPago customers will be able to access PayPal merchants globally while PayPal customers will be able to buy from MercadoLibre marketplace merchants. The transaction validates MercadoLibre as a fintech player with PayPal not only investing but partnering to help them grow.

The Spaceship Universe Portfolio currently invests in MercadoLibre.

Important! We’re sharing with you our thoughts on the companies in which Spaceship Voyager invests for your informational purposes only. We think it’s important (and interesting!) to let you know what’s happening with Spaceship Voyager’s investments. However, we are not making recommendations to buy or sell holdings in a specific company. Past performance isn’t a reliable indicator or guarantee of future performance.