Dear investors,

May marked the fifth anniversary of the first two Spaceship Voyager portfolios: the Spaceship Universe Portfolio and Spaceship Origin Portfolio.

As you're likely aware, it’s been a challenging period that’s included a global pandemic, lockdowns, supply chain disruptions, the resurgence of inflation, the most rapid interest rate hikes witnessed in four decades (with US interest rates rising from nearly 0 to 5% in just over a year), the Ukraine war, and now a banking crisis in the United States. These macroeconomic uncertainties have made investing in innovation a formidable task, and we thank you for your ongoing support.

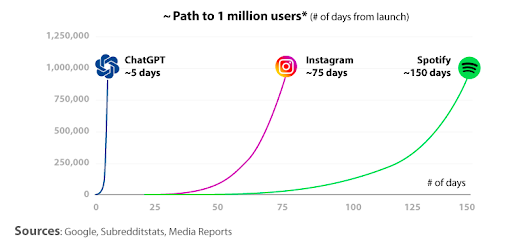

Yet despite all these concerns, we are seeing the relentless rise of innovation which doesn’t stop for anyone or anything. The advent of ChatGPT and other applications has introduced a user interface for artificial intelligence (AI) that has been adopted at one of the fastest rates ever seen by users (see below), creating the potential for another large technology shift that both the Spaceship Universe Portfolio and Spaceship Earth Portfolio are well positioned for.

Where is the World Going?

Before we delve into AI, it’s worth discussing the investment process, what we do and do not do.

The Where the World is Going (WWG) process invests in trends we perceive to be more predictable than macroeconomic developments that are difficult to predict.

WWG does not invest on the basis of short term forecasts because let's be honest, no one has been able to predict all of the scenarios above.

The previous year was particularly difficult, with macro concerns trumping business trends. Despite this, we maintain our belief that investing in innovation over the long term has a higher probability of success rather than reacting to difficult-to-forecast events.

AI is the largest WWG trend

This year has seen a notable surge in interest around AI. We believe the Spaceship Universe and Spaceship Earth portfolios are strategically well positioned to benefit from this trend.

We didn’t foresee the emergence of ChatGPT, but we do recognise the potential for AI to revolutionise multiple industries, with our largest trends revolving around AI and data.

The transition to mobile and the app economy impacted sectors such as media, gaming and retail, and gave rise to the likes of new companies like Airbnb and Uber.

We believe AI has the potential to transform almost every industry and make existing incumbents with data and customer relationships even stronger.

Previously AI primarily operated in the background, powering content recommendation engines such as those used by Netflix and Spotify.

Now users are directly interacting with AI, with ChatGPT generating content, not just recommendations.

Among the early AI applications, one notable example involves software developers and GitHub (which is owned by Microsoft, a Spaceship Universe and Spaceship Earth holding).

GitHub serves as a platform for software developers, facilitating code storage, management, and tracking of code changes.

GitHub used AI to create GitHub Copilot, an assistant that draws context from comments to suggest lines of code.

GitHub Copilot saw developers complete tasks 55% faster than developers who didn’t use GitHub Copilot.

These are tremendous productivity gains, particularly as software developers have been a key growth bottleneck and constraint for many companies.

Enhanced developer productivity itself should speed up overall innovation through accelerated release cycles and more frequent updates.

With AI, everyone can be a programmer

According to Jensen Huang, the CEO of chipmaker Nvidia (whose graphic processing units are driving the AI boom) generative AI has the potential for “everyone [to] be a programmer.”

“The programming barrier is incredibly low,” he told a forum in May. “Everyone is a programmer now—you just have to say something to the computer.”

AI can create images with simple text prompts; we’re likely to see AI programming other programs, our own digital personal assistants and provide other benefits we can only speculate about.

AI possesses the capacity to comprehend and generate human and coding languages but we think the most interesting developments involve enhancing our understanding of the language of biology, proteins and chemicals. Once these languages are understood in the same way coding is, there is the potential to generate even more accurate predictions, leading to more breakthroughs and productivity benefits.

The Spaceship Universe and Spaceship Earth portfolios have exposure to the AI thematic through:

- Semiconductors, the building blocks for chips to run AI algorithms

- Automation, the use of algorithms in combination with cameras and sensors

- Cloud service providers, that provide on demand access to computer resources and AI

- Software companies that leverage AI and data storage with proprietary data sets

- Personalisation, such as healthcare diagnosis implementing AI to improve efficiencies

- Content creators, with AI generating ideas and content.

We estimate that both the Spaceship Universe and Spaceship Earth funds have significant exposure (perhaps more than 50%) to these trends, which can be advantageous for companies embracing AI adoption.

What we could have done differently

The worst performers in our Spaceship Universe and Spaceship Earth portfolios have been negatively cash flow generating businesses whose value has fallen more than 75% from peak levels.

To mitigate that risk, we aim to limit exposure to emerging businesses that are still reinvesting for growth to 10% of the portfolio.

These investments have been impacted by higher interest rates and lower technology spending.

As such, in hindsight, we could have reduced this allocation even further, given the share price falls.

However, we maintain our long term investment approach of averaging down, though as we will explain, this has caused additional short term losses.

Short term pain for hopefully long term gain

One of these emerging growth examples is Twilio (a Spaceship Universe and Spaceship Earth holding), a leader in communication software.

As an example, let’s say Twilio is a 2% position. This means that we would keep the value of the stock at roughly 2% of the total portfolio value, rebalancing quarterly.

As the value of Twilio shares declined by 50% the position decreased to a 1% portfolio weighting, resulting in a 1% loss.

We rebalanced Twilio back to 2% by buying more shares but unfortunately these shares experienced another 50% drop.

A 75% decline consists of two 50% corrections.

So now Twilio is sitting on a portfolio loss of 2%, with a position size of 2%.

Maintaining a long-term focus averaging in on Twilio’s decline has caused additional short-term losses, but we believe most of these companies are on the pathway to profitability and the volatility is an opportunity for long term holders.

Considering the 'averaging in' of positions, we expect to benefit when these companies achieve profitability.

Shares of innovative businesses are more volatile than the underlying business

Why do we invest in some of these early stage businesses? They have been an ample source of opportunities.

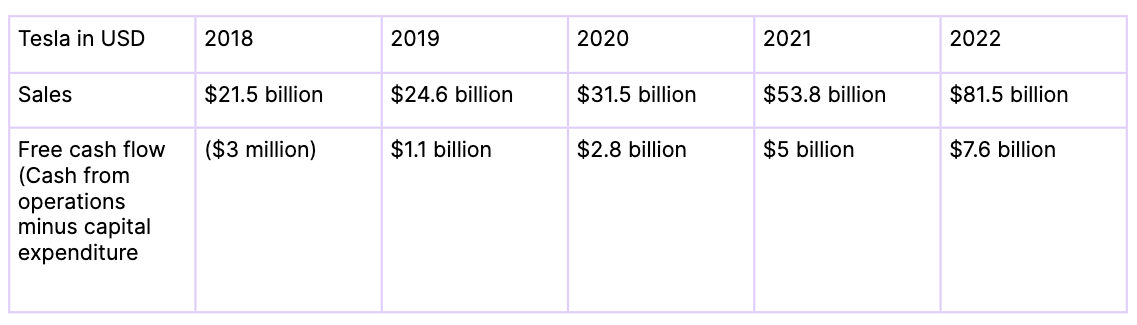

Large gains can be made from newer businesses that grow from losses to profitability, a portfolio example being Tesla (a Spaceship Universe and Spaceship Earth holding).

Spaceship Universe has owned Tesla since the fund's inception in 2018, when Tesla was generating US$21.5 billion in sales and negative free cash flow of -US$3 million.

At the end of 2022, Tesla was generating US$7.6 billion in cash flow.

Based on the financials displayed above, nobody would have contemplated selling the stock.

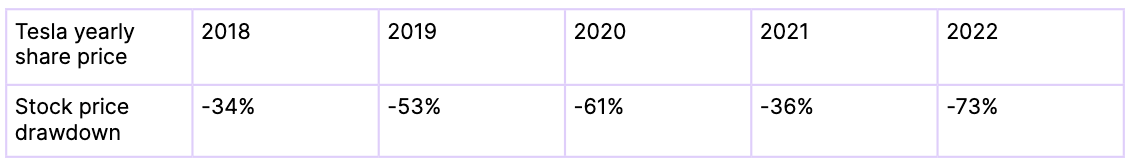

However, Tesla shares were extremely volatile, as evident from the table below showcasing yearly stock drawdowns below.

The average yearly decline over our holding period was 51%.

Throughout the journey there have been random tweets from Elon Musk, as well as bankruptcy and competition concerns, but as the above table shows business results were consistent, sales continued to grow and cash flows improved considerably.

Tesla serves as an extreme example; we cannot promise another Tesla-like outcome. Nonetheless, the WWG process is tilted towards innovation, so gains from winners such as Tesla offset businesses that do not reach the scale we initially believed.

Despite the volatility, since inception to the end of mid-June 2023, Tesla shares have returned 1419% to the Spaceship Universe portfolio.

Higher interest rates have both negative and positive effects

The WWG process remains unchanged, but higher interest rates are having an impact.

Higher interest rates yield both negative and positive effects.

On the downside, growth stocks with projected future profits face higher discount rates.

For example a dollar of future profit discounted back to today at a 2% interest rate is valued at 98 cents. At a 5% interest rate, a future dollar is now worth 95 cents.

This negative impact was evident last year, but the positive benefits of higher interest rates come from reduced competition that is now beginning to materialise.

The influence of rising interest rates reducing competition can be seen in the ridesharing industry, particularly with Uber (Spaceship Universe holding) versus their primary US competitor, Lyft.

As seen in the chart below, these shares traded similarly in 2021 but are now diverging due to the secondary effect of higher interest rates, which is impeding funding and causing challenges for second tier competitors.

In contrast to Uber, Lyft has not been as profitable and doesn’t have Uber’s scale, resulting in reduced earnings for drivers and weaker network effects. To improve profitability, Lyft must curtail hiring and marketing, which will in turn slow down growth, allowing Uber to take more market share.

Trust the process

The WWG process centres around analysing trends and identifying competitive advantages which can also be known as moats.

The Spaceship Universe and Spaceship Earth portfolios have a preference for investments in market leaders, driven by factors such as strong branding, scale or network effects.

However, focusing on market leaders often means paying a valuation premium for quality and longevity over ‘cheaper’ peers. Just like goods, the stock market differentiates between high and low quality, assigning higher valuations to companies deemed as high quality and durable, resulting in companies with leading market share trading at a premium to lower quality, lagging competitors.

While this strategy had a negative portfolio impact during a period of increasing interest rates, we remain confident in the ability of market-leading companies to capitalise on their dominant market positions, profitability and robust balance sheets.

We believe these advantages will enable them to capture a greater google market share from competitors facing growth constraints.

For more about Where the World is Going methodology, check out our Spaceship Voyager Reference guide.

Optimising for the long term

The past year has been disappointing in terms of share price volatility driven by the macroeconomic environment.

However there are several businesses within the Spaceship Universe and Spaceship Earth portfolios displaying consistent business execution which we expect will eventually be reflected in their share price.

While share price volatility may persist, real-world innovation continues to progress.

It's worth noting that innovations such as AI are not reliant on economic growth or globalisation.

As time progresses, we anticipate that share prices will align with underlying fundamentals and investing in innovation will prove beneficial.

We are enthusiastic about the opportunities ahead.

Thank you for your continued support.

Some of our Spaceship Voyager portfolios invest in Uber, Airbnb, Microsoft, Nvidia, Twilio, Tesla, Netflix, and Spotify at the time of writing.

Important! We’re sharing with you our thoughts on the companies in which Spaceship Voyager invests for your informational purposes only. We think it’s important (and interesting!) to let you know what’s happening with Spaceship Voyager’s investments. However, we are not making recommendations to buy or sell holdings in a specific company. Past performance isn’t a reliable indicator or guarantee of future performance.