It’s that time already!

The financial year runs from 1 July to 30 June. The Australian Tax Office (ATO) calls this an ‘income year’.

Generally, there’s not too much you have to do around this time of year, but we think it’s an annual opportunity to get your finances in tip-top shape.

So here are our top 10 to-dos to help you end your EOFY in style, and launch into the next one. 💪

1. Make your EOFY action plan 🎬

It can help you get:

a. A more accurate tax return,

b. A potentially bigger tax refund,

c. A better financial year 2026 (FY26).

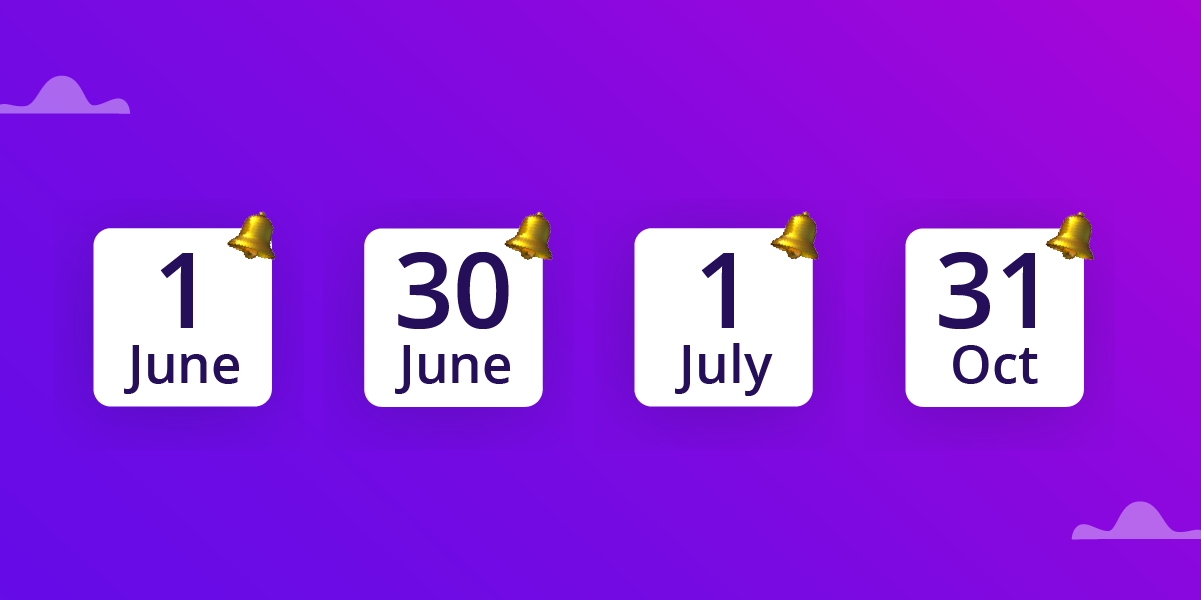

2. Put these dates in your calendar 📅

1 June

Any voluntary super contributions you want to make for this financial year need to have enough time to land in your fund by 30 June 2025, so it’s best to get them in early.

30 June

If you want to claim a tax deduction for any voluntary contributions you made in FY24, you need to submit a Notice of Intent to your super fund before you lodge your tax return or by 30 June 2025, whichever is earlier. You’ll need to wait until they send you a letter of acknowledgement before you can claim them in your tax return.

If you want to claim tax deductions on expenses, you need to pay for them by 30 June 2025.

Check the ATO’s tax deduction guide to see what you can claim for your occupation.

1 July

You can lodge your tax return from 1 July 2025, but it might be a good idea to wait a bit.

Your tax return may contain pre-filled data from government agencies, health funds, financial institutions and other companies. This information is generally available by 30 July 2025, though it can take longer.

“By lodging in early July, you are doubling your chances of having your tax return flagged as incorrect by the ATO,” the ATO has said.

31 October

Your financial providers must submit your financial statements to you by 31 October 2025. You generally need these to submit your tax return.

31 October is also the final date you can submit your personal tax return, unless you’re using an accountant. If 31 October falls on a weekend, you have until the first business day that follows it.

3. Find all your financial info 👀

If your money is spread across different apps, accounts, IOUs and gift cards, it’s a great time to get it together.

Collect your login details, account info, balances, and holdings in one place. It’ll make it easier to complete your tax return and spot opportunities to get organised.

Think:

- Bank accounts ✅

- Loan accounts ✅

- Superannuation ✅

- Investment products ✅

- Gift cards ✅

- IOUs ✅

4. Correct any out of date contact details and account info ❌

You can miss important information if your financial providers can’t contact you.

If you’ve changed your name, gotten married, moved house, or opened a new financial product over the last financial year, your details mightn’t be up to date. Review your list of financial providers and make sure your info is correct.

5. Consider sharing your tax file number ️️️📂

It may seem like a small thing – but if you don’t share your tax file number with your financial providers including your super fund, it may have unintended consequences for you.

For super:

Without a TFN,

- You’ll pay an additional ‘No TFN’ tax on any of your pre-tax contributions, and

- You won’t be able to make personal contributions.

It could also be harder to find and consolidate your accounts if you want to.

For investing:

If you haven’t shared your tax file number with your financial institutions, they may be able to withhold tax at the highest rate — which could be as high as 45% (plus 2% of the Medicare Levy).

6. Make last minute super contributions and submit your Notice of Intent 😅

If you’re saving for your first home, a low income earner, or looking to minimise your tax bill, there may be extra incentive for you to submit an extra super contribution.

If you’ve previously done this and intend to claim a tax deduction for them, be sure to submit your Notice of Intent before you lodge your tax return or 30 June, whichever is earlier. Remember to wait to receive a letter of acknowledgement before you can claim them in your tax return.

7. Made any donations? Find your receipts 🕵️

If you’ve made charitable donations during the financial year, you might be able to claim some of these back on your tax return. Generally, donations of $2 or more to registered charities can be claimed.

8. Get any tax support you need 🫶

Tax can be confusing – so get help if you need it. This could include speaking to a registered tax agent such as an accountant.

The ATO has help and support for lodging your tax return, which can include personalised support if you earn less than $70,000 and meet some other conditions.

Here’s their info about how to get tax support.

9. Make a smart plan for your tax return 🤓

In 2021, an Australian bank experimented with prompting its customers to think about how they’d use their tax refunds in advance.

It resulted in these customers making smarter financial choices.

So, think about how you’ll use your tax return in advance and it might help you make a better money decision.

This could include using it to set up an investment plan or start investing.

10. Check your financial products are still fit for purpose 🚦

Have a savings account but you’re ready to start investing?

Not quite sure what your super’s invested in?

The End of Financial Year is a great time to see if you’re still happy with your financial products, and that they align to the future you’re building.

EOFY under control?

If you’re ready to get serious about your money, start planning your new financial year.