You’ve no doubt heard of the mathematical magic of Fibonacci or Pythagoras. But what about the rule of 72?

For anyone looking for a rule of thumb to calculate how to grow money, the rule of 72 is a great little trick.

The magic number

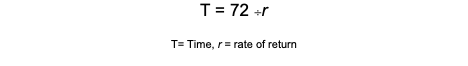

The rule of 72 is an approximation to calculate how many years it would take an investment to double.

The premise of the rule revolves around either dividing 72 by the interest rate your investment will receive, or inversely, dividing the number of years you would like to double your money in by 72 to give you the required rate of return.

The formula most commonly used results in the length of time it takes a given investment to double.

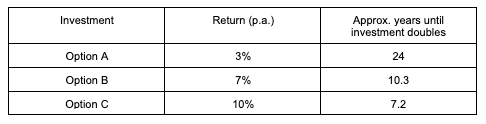

For example, say Samantha is weighing up 3 different investment scenarios to put $1,000 into:

In the table above, the speed at which you can grow money is represented by the length of time an investment would take to double in value. The time required dramatically decreases as the rate of return increases due to compounding.

At 3% p.a. (slightly higher than what most savings accounts currently offer), Option A would take about 24 years to double the initial investment of $1,000. Option B would double the original investment in just over 10 years (or less than half the time it takes an investment returning 3% p.a.)

So what?

While not completely earth shattering, the rule of 72 is a neat little trick that can help you quickly calculate the difference in speed at which your investments or savings could double.

One of the advantages of the formula, is that it accommodates for compound interest (year on year growth), rather than simple interest.

While the difference between a yearly return of 3% versus 4% seems small, at 3% it would take a 24 years, or 6 years longer to reach $2,000 in comparison to a 4% return (18 years). This goes to show how significant a small increase in return can be to growing your money.

Quick maths

In the above example, Option C, returning 10% each year doubles the initial investment in slightly more than 7 years. Obviously the higher the return, the faster it has the potential to double.

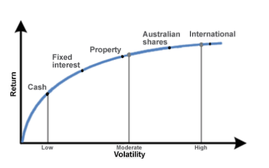

However, high return inherently comes with higher risk. This is best explained by the Sharpe Ratio, which plots the risk (volatility) against the reward (return) of a given investment.

One of our previous posts, What’s the risk details this in more length, but as can be seen below, more conservative investments tend to be lower risk / lower return, while higher risk can mean higher return and volatility.

It is important to remember while the opportunity for an investment return to be higher, there is just as much chance that such an asset can result in negative returns of similar or even greater magnitude to any gains.

The rule of 72 can come in handy when whipping out some mental arithmetic on potential returns. Approximating how quickly you can grow your money (and realising the difference it can take your savings or investments to double) between different rates of return rate of return puts the time value of money into context, and can serve as a decision point before committing to one or another.