“Stories move us. They make us feel more emotion, see new perspectives, and bring us closer to each other,” says the Netflix website.

Then it sometimes inspires us and sometimes emotionally decimates us depending on what we choose to watch that day.

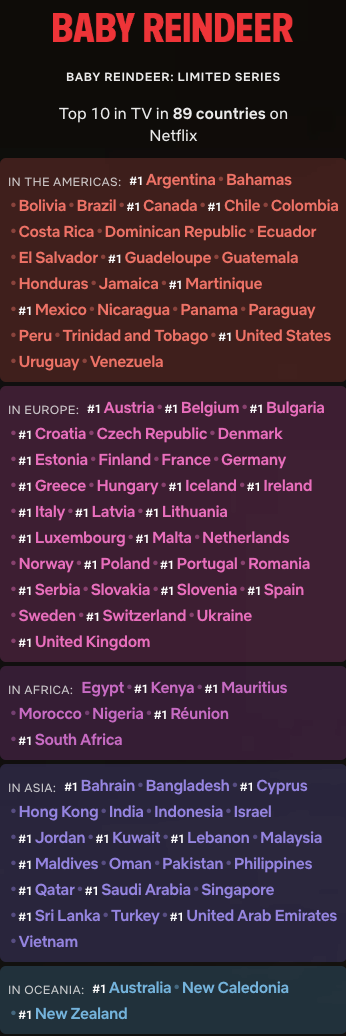

Number one in 43 countries

Over the past fortnight, limited-season drama series Baby Reindeer has seemingly come out of nowhere.

(Content warning: This show deals with themes of violence, sexual assault, transphobia, and grooming.)

Starring a Scottish comedian who was relatively unknown outside of comedy circles, and based on true stories, it’s become a surprise hit for Netflix.

Netflix is available in more than 190 countries, and Baby Reindeer has climbed to the top in 43 of them, including Australia.

Here’s a closer look at the list, thanks to Netflix.

True crime

Baby Reindeer straddles a few different genres, from comedy and drama to true crime and suspense.

Netflix has had a few big true crime hits you’ve probably seen – and the bigger Netflix gets, the bigger its shows can get too.

2015 - Making a Murderer

This docuseries recounted the true story of two relatives who were charged with various crimes; one of whom spent 18 years in prison after a wrongful conviction.

An average of 19 million people watched each of its episodes.

At the end of 2015, Netflix was worth $50.1 billion.

2020 - Tiger King

Hey all you cool cats and kittens!

You might’ve repressed memories of lockdown, but chances are you spent some of it watching Joe Exotic, Carole Baskin, and a whole bunch of wild animals muse about who killed Carole’s husband.

About 34 million US viewers watched Tiger King over the first ten days of its release.

At the end of 2020, Netflix was worth $246.2 billion.

2024 - Baby Reindeer

Which brings us to the here and now. In the week of 15 April – 21 April, Baby Reindeer had been viewed 13.3 million times, for a total 52.8 million hours. (The number of episodes in a tv show impacts watch numbers – the more episodes, the more minutes watched.)

At the time of writing, Netflix is worth $241.1 billion.

Contagious factors

There were a few factors at play that led me to watch Baby Reindeer – you might be the same.

1. Citizen detectives tap in

While the show’s creator, Richard Gadd, was careful to tell a nuanced, multi-sided story, there were definite antagonists: stalker Martha, and comedy mentor Darrien.

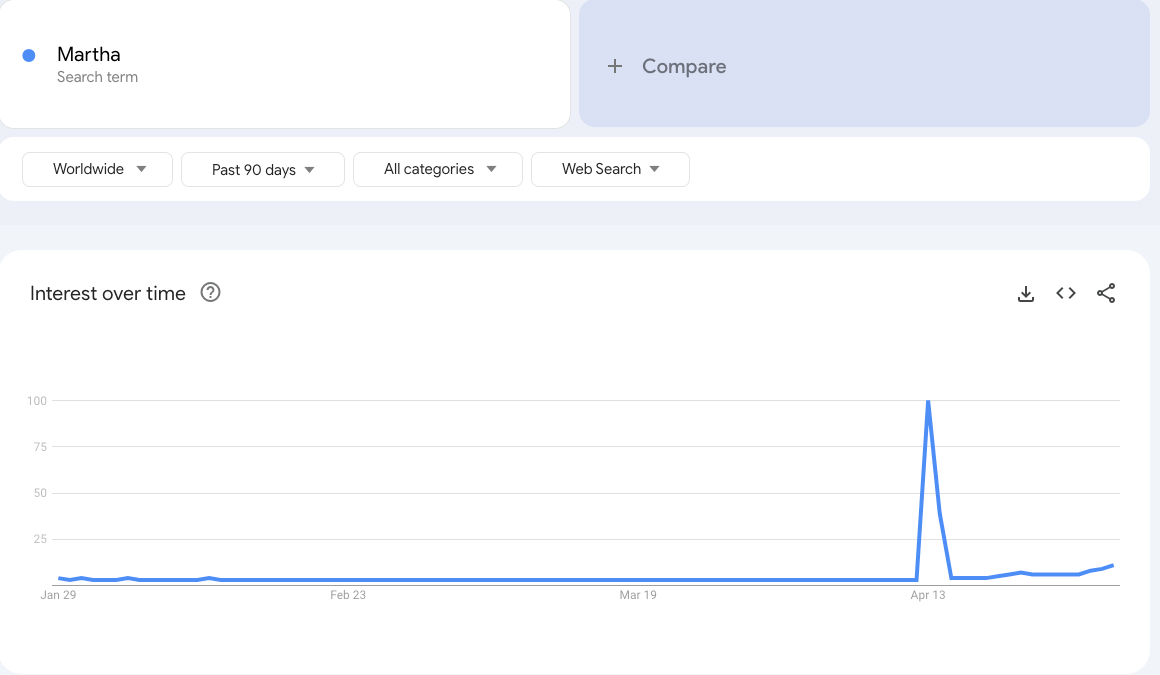

Google tells the story.

Google search interest in ‘Martha’ skyrocketed around the time of the show’s release. This is because the internet has been trying to find the real identities of Darrien and Martha ever since the show dropped.

2. The take-based economy

Everyone’s got a take. It’s what keeps the media and casual conversation going.

On Reddit:

r/OutOfTheLoop says, “What is ‘baby reindeer’ and what is going on with it?”

r/BritishTV asks, “What do we think of Baby Reindeer?”

The r/therapists subreddit asks, “I would like to ask fellow colleagues; is this a realistic depiction of how a victim feels?”

r/CasualConversation says, “It was… weird, but. Not bad to me.”

On TikTok:

“Should Martha be left alone?”

“Since Baby Reindeer came out I literally have to delete ‘sent from my iPhone from the end of my emails.”

@taraalkattan This show has changed me forever #netflix #babyreindeer ♬ original sound - TrendingVideoClips1

The take-based economy is largely powered by media headlines, such as:

‘Baby Reindeer’: Woman outed as alleged stalker may sue Netflix creator (Business Insider)

‘The truth about the comedian and his female stalker in Baby Reindeer’ (Daily Mail)

‘Baby Reindeer creator asks fans to stop hunting down the real people from the Netflix show’ (ABC)

Even if you haven’t watched the show, you’ve heard about it by now, and you’re probably more likely to.

3. The ratings

At the time of writing, Baby Reindeer has a 4.2 star rating on Letterboxd; a 97% rating on Rotten Tomatoes; and 8.1/10 on IMDB.

“For many consumers, making a decision on movie night starts with combing online ratings and reviews,” says The University of Denver online.

“Nearly 90% of consumers who read online reviews use such reviews to assist their purchase decisions. Specifically, in the movie industry, research has confirmed the economic impact of online reviews.”

Whether you paid with your wallet or your time, if you saw a Baby Reindeer review it likely had a hand in persuading you to hand it over.

4. Your Netflix addiction

“It can be hard to be a grownup, because no one is telling us to stop,” writes Catherine L. Franssen, a Neuroscience Professor from Longwood University.

In 2017, for The Huffington Post, she detailed some of the features that make watching Netflix such a sticky experience:

- Episode cliffhangers activate the flight or fight response, keeping you alert and/or alarmed (and unable to sleep);

- Finishing episodes and entire seasons activate the reward centre of your brain;

- Your mind is better at chunking time into 30 and 60 minute intervals, and Netflix is prone to give you 20 and 40 minute episodes.

Baby Reindeer had seven episodes, each between 28 and 45 minutes long, each ending on a cliffhanger.

Network effects

Baby Reindeer is a good example of a network effect, which is a feature that some investors, including the Spaceship Voyager Investment Team, look for when deciding which company to invest in.

The network effect means that a product or service gets more valuable when more people use it. A tv show with a huge amount of virality has an inbuilt network effect. Netflix, too, benefits because viewers need a subscription to be able to participate fully in the conversation. That’s good for Netflix’s metrics, which are good for its bottom line.

Netflix is in our Spaceship Universe Portfolio.

The Spaceship Universe Portfolio invests in companies we think meet our Where the World is Going (WWG) criteria, which includes a focus on long-term trends.

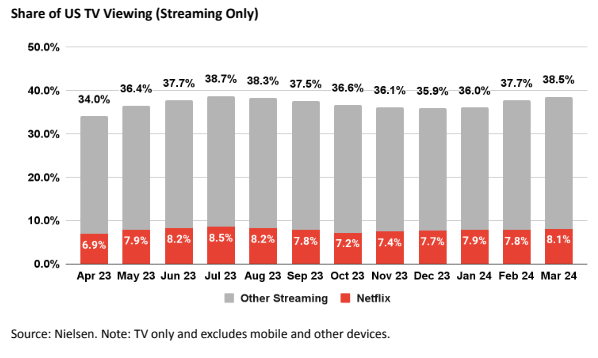

We believe Netflix is WWG because it has exposure to the Streaming Media WWG trend.

This is the investing trend that includes companies that produce subscription based online audio and video services, including live events. It can include both hardware and software, original and licensed content. The size of the streaming media market is predicted to increase 7.86% per year until 2028, according to Mordor Intelligence.

What else do we like about Netflix? We asked our Spaceship Voyager Investment Team.

“We initiated our position in Netflix towards the end of 2022, the stock had de-rated a bit and we bought it closer to a market capitalisation of US$130 billion, on around 21x one year forward price to earnings ratio at the time. The business now has a market capitalisation of US$241 billion (+85%).

Our thesis at the time was that competition was easing with Disney, Disney grew very rapidly over the past few years catching up to Netflix in terms of subscribers across its brands (Disney+, Hulu, ESPN).

But in 2022, Disney started to increase prices, a signal of competition easing in the market. Netflix also had the catalysts of growth in subscribers and average revenue per subscriber in Asia, cracking down on password sharing, advertising, and expanding into gaming and live sports.

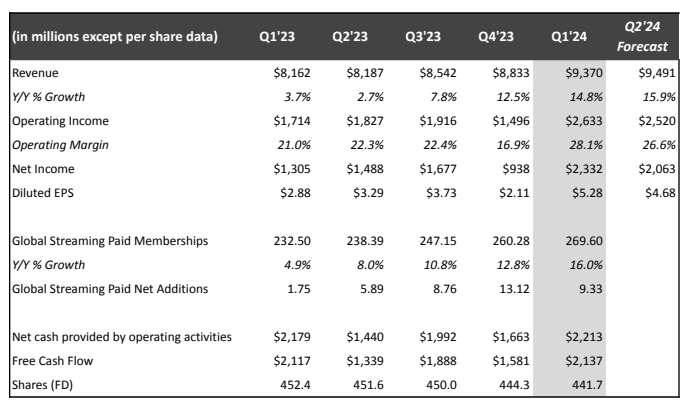

In the first quarter of this year, Netflix has added 9.3 million subscribers bringing the total to 270 million global subscribers. The company reported profits of US$2.3 billion (+77% year/ year), revenue grew 15%y/y to US$9.37 billion. The company’s released a Letter to Shareholders which outlines their result and guidance.

While a lot of the catalysts such as password sharing, increasing prices, launching new movies and series have resulted in strong earnings growth for the business, other new ventures such as sports and gaming are in early days. Even monetisation outside the US has a long runway for growth in our view.

The success of shows such as Baby Reindeer is a strong indicator of the power of the platform that Netflix has built. The show was promoted with a banner on Netflix, and in its curated list of top shows in each country, which encouraged users to click.

Gaining visibility on platforms is a large trend, we’re seeing this in Amazon as merchants advertise to get more visibility, resulting in Amazon being the third largest advertiser in the US.

We’re now seeing Uber, and Grab increase advertising as well. The incremental margins from ads are high and would contribute significantly to the bottom line.

Netflix has built an incredible platform to help their customers discover new shows and the success of Baby Reindeer shows their power of promoting a show resulting in views globally. They are one of the biggest investors in content in the world. They have built a platform with 270 million subscribers. They have scaled profitably at a time when the large studios and other streaming services have been struggling.

We think Netflix is a quality business in a dominant position in the global streaming market, and we continue to hold our position in the Spaceship Universe Portfolio."

Some of our Spaceship Voyager portfolios invest in Netflix, Disney, Uber, and Grab at the time of writing.

Important! We’re sharing with you our thoughts on the companies in which Spaceship Voyager invests for your informational purposes only. We think it’s important (and interesting!) to let you know what’s happening with Spaceship Voyager’s investments. However, we are not making recommendations to buy or sell holdings in a specific company. Past performance isn’t a reliable indicator or guarantee of future performance.